introduction

While US regulators appear to be loosening enforcement against misleading sustainability disclosures (as evidenced by the SEC’s recent disbandment of its ESG Enforcement Task Force), Canadian regulators are becoming more aggressive.

Regulatory scrutiny of “greenwashing” has increased significantly in Canada. What was once an opportunity for Canadian companies to freely promote their ESG efforts is now an area of increased risk due to increased accountability for sustainability reporting.

The recent enactment of Bill C-59 introduces stricter regulations regarding environmental claims, giving greater powers to the Competition Bureau of Canada and empowering private parties to seek penalties for violations. As interim emissions reduction targets for 2030 approach, there is increasing pressure on companies to review their language and carefully position their sustainability efforts. An analysis of 52 TSX 60-listed companies found that 6% have suspended or removed sustainability reporting while awaiting clearer guidance, and 35% have reported off-track or reset ESG targets I did.

Despite these changes, sustainability reporting remains strong, with most companies reporting on global We comply with the appropriate reporting framework. Trends include a shift in terminology, with “sustainability” increasingly replacing “ESG” in reports, and an emphasis on external assurance regarding ESG data, particularly environmental information. The content of the sustainability report has been expanded to address the company’s most important material issues. Notably, more than one-third of companies surveyed use reports to highlight their policies on the responsible use of AI.

2025 will be a pivotal year for sustainability reporting in Canada, as several events converge to impact how companies communicate their sustainability efforts. A federal election to keep Canada’s carbon tax on the ballot may be held sooner than expected, the implementation of Bill C-59 and the proposed introduction of the Canadian Sustainability Disclosure Standard (CSDS) could change the way companies manage sustainability. It will have a big impact. Report.

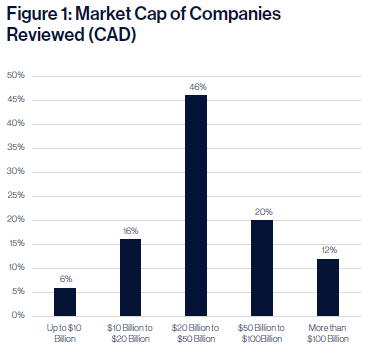

To help companies prepare for a complex and changing environment, Teneo is publishing its first ever “Canada’s State of Sustainability Report,” which analyzes 52 TSX 60-listed companies. In this report, we (i) provide an overview of our methodology; (ii) Top 10 key points. (iii) 25 key data points from analysis of the 2024 Sustainability Report; Previous reports in Teneo’s 2024 Sustainability Series provided similar analysis of U.S. sustainability reports and key issues for companies currently issuing sustainability reports.

Research method

We have analyzed over 80% of the TSX 60 corporate sustainability reports (the “2024 Sustainability Reports”). For the purposes of this report, all references to the 2024 Sustainability Report, regardless of naming convention, refer to the Annual ESG Disclosure Report.

Key takeaways from 202 sustainability reports

01: Bill C-59 brings increased scrutiny to environmental claims.

Bill C-59 has been enacted, enacting strict requirements for environmental claims and strengthening the Competition Bureau’s powers and the ability of private parties to seek significant penalties, ensuring that companies are protected against all current and planned environmental claims. Communication needs to be reviewed. While the full impact of the new law is still unknown, companies should expect new challenges heading into the 2025 reporting cycle. With Canada’s federal election just around the corner, it remains to be seen whether this law will remain in its current form long term.

02: Sustainability reporting has been suspended pending regulatory clarity.

The four companies participating in the TSX 60 have issued disclaimers and temporarily removed sustainability reporting content from their websites, social media and other public communications pending clarification from the Competition Bureau of Canada.

03: The Canadian Sustainability Standards Board (CSSB) aims to shape the future of sustainability reporting in Canada.

Currently, CSSB is referenced in only 14% of reports. However, once the CSSB’s first two CSDSs are completed and become voluntary effective after January 1, 2025, these standards will become an influential role for regulators in determining mandatory rules for sustainability-related disclosures. Serves as a reference.

04: Companies commit to achieving net zero by 2050.

70% of companies surveyed have set out net zero commitments by 2050, in line with the global commitments set out in the Paris Agreement. Additionally, 66% have set interim reduction targets for 2030. On average, companies with interim targets for 2030 aim to reduce absolute emissions by 42% and emissions intensity by 38%.

05: ESG targets are under consideration.

The progress of reviewed companies’ sustainability goals is actively measured and reassessed. Of the companies surveyed, 35% said at least one ESG objective was “off track” or “repositioned.”

06: SASB, TCFD, and GRI take the lead.

The majority of sustainability reports in 2024 will be based on the SASB (93%), TCFD (88%) and GRI (87%) frameworks, followed by the UN SDGs (68%) .

07: Sustainability reporting is expanding.

The average length of sustainability reports in 2024 increased to 95 pages, an increase of 3 pages compared to 2023. The total length of the reports varied widely, with the longest report being 228 pages and the shortest being 22 pages.

08: The reporting language has shifted from “ESG” to “Sustainability.”

Almost half of all sustainability reports in 2024 used “sustainability” in the title, an increase of 6% year-on-year, while the use of “ESG” decreased by 8%. Across all reports, total mentions of ‘ESG’ decreased by an average of 17% from 2023.

09: Obtaining external guarantees is becoming more common.

Most companies (71%) have external assurance for at least one ESG data point, and 62% only cover environmental data. KPMG was the auditor of choice, providing external assurance for 29% of the reports reviewed.

10: Materiality evaluation is increasing.

Most companies (80%) have conducted an ESG materiality assessment, with 54% having done so within the past two years. Although single materiality assessments remain the most common, 28% of companies have adopted a dual materiality approach, reporting on both impact materiality and financial materiality. . This number is slightly higher than in the United States.

conclusion

Sustainability reporting in Canada is at a tipping point. In 2025, businesses will face a more complex regulatory landscape due to the potential implementation of Bill C-59, a potential federal election, and the launch of the CSDS. To navigate these uncertainties, companies must closely monitor political, social and regulatory developments and be prepared to adapt quickly. Companies that do so will be in a better position to manage emerging risks, meet stakeholder expectations, and communicate effectively.

Key statistics from the 2024 Sustainability Report

I. 2024 Sustainability Report Communication Features

II. Characteristics of the 2024 Sustainability Report Content

III. 2024 Sustainability Report Governance Features

The views and opinions expressed in these articles are solely those of the authors and do not necessarily reflect the views and opinions of Teneo. They are provided to stimulate thought and discussion and are not intended to constitute legal, financial, accounting, tax, or other professional advice or counsel.