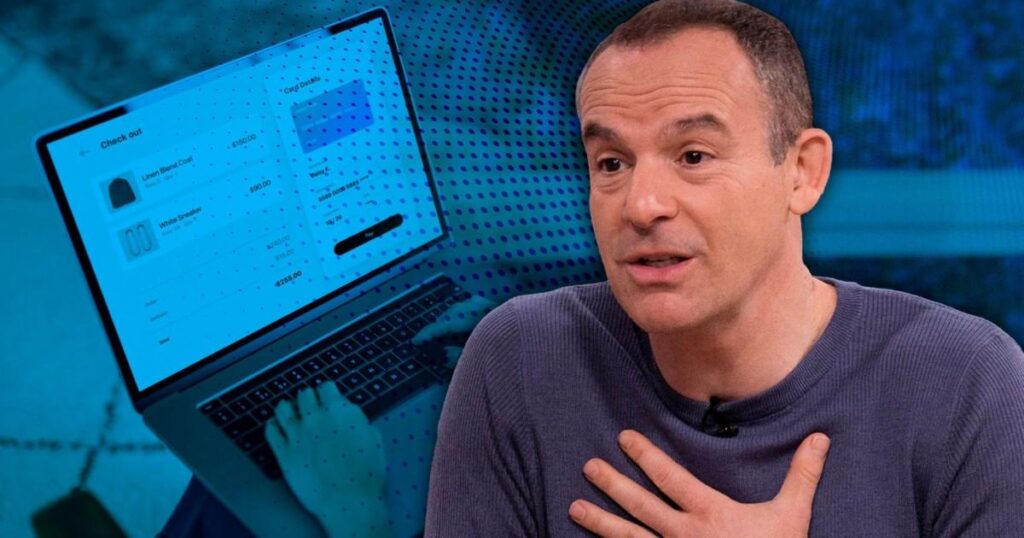

Martin Lewis has issued an urgent warning over a ‘quick and easy’ online checkout option that might not be as secure as it seems.

The Money Saving Expert founder took to social media platform X to share a word of caution over the ‘pay by bank app’ feature now available at many retailers.

While the payment method – which requires users to open their banking app to approve the transaction, might be faster than inputting their card details – Martin claimed it offers ‘little protection’.

He explained: ‘It’s on the likes of Just Eat and Ryanair. You don’t give card details, just pick your bank, and log into the app (via biometrics) then it’s done.’

A variety of banks and card companies, including Barclays, Mastercard and Santander, allow customers to use the pay by bank app option, with merchants from Funky Pigeon to Caffe Nero signed up as retail partners.

However, the finance guru highlights that these transactions are registered as bank transfers rather than card payments, meaning customers ‘don’t get the same refund rights like chargeback or Section 75 if something goes wrong’.

Section 75 of the Consumer Credit Act 1974 protects consumers who use a credit card to make purchases, while chargebacks allow customers to ask their bank to refund payments for services or goods bought on a debit card.

Martin claimed it’s ‘no biggie’ to use the tool for small purchases, but urge: ‘Beware with big important transactions’.

In the X thread, a few commenters pointed out that HMRC takes payment this way, although he replied: ‘I’d be less worried about that (as long as it’s the real HMRC) as that’s something you may pay by bank transfer anyway (and this is just one of those) and not something you’d get “purchase protection” on.’

He also hinted that there would be ‘more coming’ about the payment option on Money Saving Expert soon.

It follows MSE offering advice to the UK’s 36.2 million credit card holders, with Martin calling minimum payments an ‘evil genius’ technique by lenders.

Claiming minimum payments could spell ‘danger’ for your finances, he added: ‘They’re designed to keep you in debt for decades, as you repay a percentage of what you owe, so payments reduce with the debt.’

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.

MORE: Emmerdale fans baffled as they call out major Aaron and John plothole

MORE: ‘Report immediately’ EastEnders issues serious ‘cast’ warning to fans